March 17 2023

Recap

The current banking crisis is a result of poor decisions made during the Covid-19 pandemic. The lockdown economy, money printing, and lowering interest rates have all contributed to the massive costs that have to be borne at some point. The Federal Reserve's claim that inflation is transitory has proven false, and their subsequent rapid raising of interest rates may also be misguided. With global debt at 360% of global GDP, the question of who to blame for the banking crisis is a political Rorschach test, with possible culprits ranging from those running the banks and the Fed's interest rate spike to the Biden administration's spending and the claim of transitory inflation in 2021.

Deregulation in 2018 has also played a role, creating a two-tiered system of banks: too-big-to-fail banks and smaller, poorly regulated institutions. Some may argue that "wokeness" or ESG factors are to blame, though this may not be entirely fair. It's also difficult to blame VCs, who are essentially depositors, although there may be conflicts of interest when SVB acts as an LP for some VC funds.

As the Fed created a buyer of last resort this weekend, it's worth marking our calendars for March 15, 2024, to see what the future holds. The global debt problem is manifesting in massive protests in France, the Netherlands, and issues in London. Pension liabilities are looming in the US, and the only way to handle this debt may be through significantly higher tax rates or extraordinary productivity gains in areas like AI, automation, and energy.

People are seeking the security of a bank vault, yet some blame depositors for opening accounts in Moody's A-rated and FDIC-compliant banks. Just two days before bank failures, Powell testified that he didn't see systemic risk. Washington's money-printing has created inflation, and banks' operating costs mean they're allowed to use your money for their operations. Ideally, we should enforce laws in code, allowing for regulators to have 100% transparency into how these organizations run.

In the VC market, Founders Fund has split its flagship fund, Stripe's valuation was slashed, and UC's endowment has seen lackluster returns from Sequoia. Tiger is struggling, Y Combinator has cut staff and scaled back growth-stage investments, and startups and VCs are facing hard times.

Superconductors could revolutionize energy transmission, with potential applications in transportation, microprocessors, and battery storage. The search for room-temperature superconductivity continues, with recent breakthroughs in hydride materials sparking hope for innovation.

The technology transfer landscape at universities is varied and complex, with differing approaches to equity stakes and partnerships. Quantum computing could play a significant role in the future of superconductors and other technologies.

Raw Notes

- Chamath had a laura piana dinner

- SVB week recap

- People reacting to Jason’s all caps tweeting

- WSJ editorial blaming Bill Ackman and Sacks for panic spreading

- Silvergate failed - people blaming crypto

- SVB - people blamed VCs

- Signature bank

- First Republic having issues

- Credit Suisse - backed by Swiss government

- So that means many banks getting hit by high interest rates

- Pod came out after bank already closed so hard to be honest about them getting

- First Republic and Credit Suisse issues might be different from the other 3

- Banking crisis

- What is happening now is result of bad decisions made during Covid

- Lockdown economy, print money, lower rates, so massive cost had to be borne at some point

- Fed said inflation is transitory - that was wrong

- They raised rates like crazy - that seems wrong too

- 360% global debt to global GDP right now

- Question of who to blame for the banking crisis is a political rorshach test

- People running the banks

- Spike in interest rates by Fed

- Biden administration spending (but started with Trump)

- Inflation claim of transitory in 2021 - everything went up in price

- Dereg in 2018 - Warren and Khanna make a good point - creating 2 tiers of banks - TBTF banks vs smaller banks which are poorly regulated and so people are less confident about them

- Wokeness/ESG? (probably not fair though banks should have paid more attention to business)

- VCs (how can you blame depositors)

- SVB has acted as LP for some VC funds - this seems like a conflict of interest maybe

- Fed created a buyer of last resort this weekend

- Mark your calendar for a year from now - March 15 2024 - what will we do?

- Global Debt problem

-

Massive protests in France

-

Massive protests in Netherlands

-

Issues in London

-

Pension liabilities are coming up in the US

-

Blew a hole in the boat AND a massive weight that will fall on the boat

-

Only stop gap in the next decade is going to be significantly higher tax rates in the US

-

Only other way is some extraordinary productivity gain

-

AI, automation, energy

- Productivity can then go through the roof

-

People want a bank vault

-

People are blaming the depositors for opening an account in a Moody’s A rated bank and FDIC compliant bank

-

2 days before bank failures Powell was testifying he didn’t see systemic risk

-

Washington created inflation with money printing

-

Banks have operating costs - so they are allowed to use your money for their operations

-

We should be able to enforce laws in code - this way regulators have 100% transparency into how these organizations run

-

If you are depositor in a bank you could be an investor in someone’s mortgage

-

$7T in deposits in banks

-

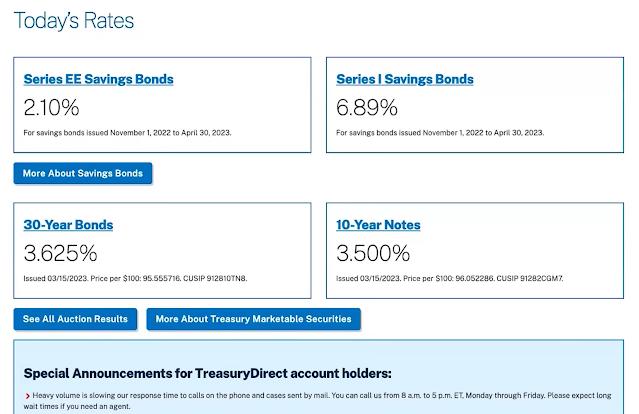

Can invest in government t bills

-

Have 3-4 bank accounts

-

- VC markets

- Founders Fund split

- Slashed size of its flagship VC fund

- $1.8B → 2 * $900M (apparently Peter Thiel pushed for this0

- Slashed size of its flagship VC fund

- Stripe valuation slashed to $50B - raised $6.5B

- UC endowment invested $800M in Sequioa since 2018 and has returned $40M or so since then

- Tiger not doing well

- YC cut 20% staff, scales back growth stage investments

- YC unicorn hit rate is ~6%

- So hard times for startups and VCs

- No more getting credit for work not done

- Founders Fund split

- Superconductors

- Today 15% of power lost in transmission of power to homes

- You could have powerless transportation

- More powerful microprocessors - could use just 1% of the energy of a semiconductor

- Could have infinite battery storage

- Actual loss could be less than 5%

- In 1911 or so they found superconductor by making mercury really cool

- In 1987 Chu made superconductor without having to cool things so much

- Temperature of liquid nitrogen

- People trying to find superconductivity at room temperature

- Found in DNA - but not scalable

- Recently found in hydride

- Ranga Dias and team published paper - could be controversial or kickstart a whole new wave of innovation

- Chamath has met Ranga Dias through Venkat Viswanathan from CMU - was not able to invest because Rochester blocked him

- Stanford got 1% of Google

- CMU ranked top tech transfer university

- Universities’ tech transfer offices are all over the places - some want 60%, some don’t care, some only work with some VCs, etc

- Quantum Computing could have a big role to play

- Ukraine war

- Monthly run rate of this war is more than Afghanistan war

- JCaps, King of Caps locks

Comments