August 12 2022

-

Chamath at Island of Sardinia, JCal at Lake Tahoe

-

Softbank

-

$59B gain over 2 vision funds, $21B loss

-

Tokugawa Ieyasu

- 1st Shogun of Tokugawa Shogunate

- $6T yen loss in past 6 months - needs to remind himself

-

Embarrassed and remorseful

-

Amount of capital being put in dropping a lot

-

Made $125B off of Alibaba by putting in $25-$30M

-

Saudi Arabia and Abu Dhabi have been smart about their investment in SoftBank

-

There was downside protection built in for the LPs

-

He has an amazing track record over 50 years - he will land on his feet - he admits he made his mistake

-

Sure they should have cashed their chips earlier but its OK - he will learn

-

Its not clear that only Softbank caused this bubble, even Tiger put in, there were cross over funds - sovereign wealth funds and liquidity ($10T over the last couple of years) - many billions came into tech - and VC is not that scalable and the attempt was made to make it scalable, it didn’t work

-

Masa’s model - you ask for $25M, he will give $150M, you ask for $100M, he will give you $400M - problem became that capital became primary asset - that’s a problem, capital should accelerate, not become primary asset

-

He put oversized checks in, with too much money to deploy, their fundamental profitability and unit economics was ruined

-

This strategy could help - Blitzscaling with Reid Hoffman, Peter Thiel with monopoly - if asset cannot handle the capital

-

The rate at which you can deploy capital does not flex - cannot flex beyond natural condition of business

-

Kingmaker strategy didn’t go down well - shows VCs can be helpful but they can’t make winning companies become the winner

-

Tiger improved on this model - they would be passive, non dilutive rounds, they don’t want to influence you too much - they don’t want to be king maker

-

They wrote multi-$100M checks into companies at seed stage

-

$500M seed checks into robotics companies

-

The VC does not have the thesis, the Founder has the thesis

-

Craft Ventures does growth investing milestone based

-

SoftBank is good at doing SaaS deals, they are easy to work with - they should do more deals like that

-

Their 1 mistake could be - they made it a 10 year fund - so their investment period is only 5 years - can only put money in the first 5 years and next 5 years is new fund

-

$10B in 5 years is $2B/year - so putting in too much

-

Blackstone, Silverlake came in after Softbank and started 15 year life or so

-

The quality of the diligence was zero basically - so they had to have a broad and large and diffuse investing team

-

Investing is not a team sport - its like Basketball, you’re Steph Curry or you’re not

-

Benchmark, etc are following that strategy - coz there are amazing investment people

-

Hard to pare down a position when company is private because companies don’t want you to

-

Seems like SoftBank had a lot of public positions and debt and they could have paid it off

-

Hindsight is 20/20

-

1999 and 2021 bubbles are very powerful psychological

-

When conversations are about valuations vs quality of earnings, you’re more likely in a bubble

-

Sacks will pay attention to public valuations, to see how they trickle down to private markets

- Also will look at interest rate policies - we are all massively impacted by macro economic policy

-

Interesting comparison between Softbank and Sequoia and Insight

-

-

US Macroeconomic Picture

- Overall economic data is mixed - but some good data points

- Inflation 9.1 to 8.5

- Inflation was YoY, now its MoM

- Recession used to mean 2 quarters of -ve growth, now we can’t know until mysterious economics board comes back with decision

- Keep redefining terms instead of admit what the data is

- Jobs picture is good

- Technically in recession

- Wouldn’t be surprised with +ve GDP growth in Q3 and Q4

- But next year rate hikes will drop - construction industry has been hit - home prices are at a 40 year low

- This industry is bellwether for recession

- Significant risk that we are back in recession next year

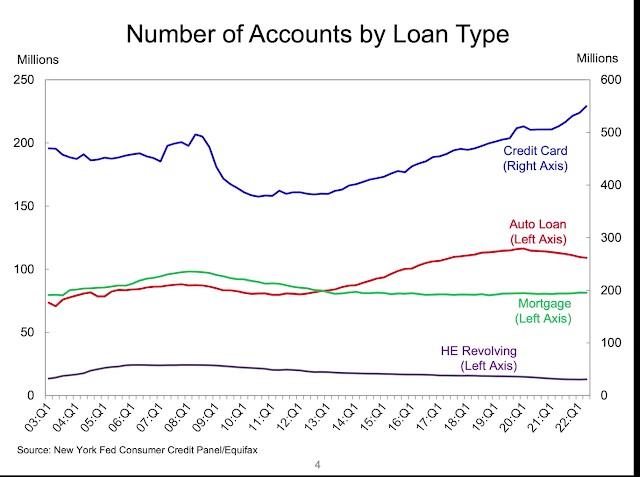

- Credit card debt is high - rising consumer credit balance in rising rate environment is concerning

-

Household debt rising to $16T - variable rates is bad

-

Consumer debt rise could outpace Asset valuation growth

-

This means we could have a bad crunch

-

President is passing an inflation reduction act to cure 0% inflation to cure a recession that doesn’t exist - this is the posture of the administration

-

2 sides of equation are:

- How does increasing rates reduce inflation

- How does increasing rates affect recession

-

- Overall economic data is mixed - but some good data points

-

Trump Mar a Lago FBI raid

- 30 FBI agents, carrying AR-15s, with body armor raid

- Andrew Cuomo and Andrew Yang were intellectually honest when they criticized the raid

- The case for Biden to get elected was to move past Trump and get past partisan warfare

- It seems we’re right back in this thing - the media is obsessed with TDS - they have to produce nuclear documents first

- The last time the FBI did this - they manufactured a warrant to the FISA court

- They were political since their inception - they lied to the press to get Trump (55m)

- An FBI lawyer pled guilty to falsifying documents - so its in their history

- The lack of trust isn’t earned - we don’t know what Trump did or didn’t do - you can’t just accept at face value leaked comments by the FBI

- In their earliest days they engaged in corruption - they defended the KKK

- Trump was elected on platform that there is institutional corruption in the deep state

- When Trump was in office the FBI leaked texts

- FBI has polarized the outcomes - they will send him to Big House or White House

- Biden had historians in the White House - they said conditions in US are just like they were before the Civil War

- Leak seems selective leak

- Whatever the outcome is, it will not be good - both extremes will be further inflamed

- They didn’t let Trump’s lawyers watch them

- This way you won’t be accused of planting stuff

- The inflammatory index is too high

- Trump has been pulled right back into the main stage

- The people inside for 6-7 hours or 9 hours - told Trump’s people to leave, turn their cameras off

- They went through Melania’s stuff

Comments