August 20 2022

- Friedberg is moderating!!!!

- Dave Friedberg

- Chamath Palihapitiya

- Sacks

- JCal

- Rationale for what’s going on with the podcast

- Differing points of view

- Last couple of weeks have been a struggle

- Adam Neumann is back

- $350M from A16z

- Flow - residential apartments

- 3000 apartment unites in Miami, Fort Lauderdale, Atlanta, Nashville

- People are wondering why he’s able to raise funding

- His track record is great

- He started Greendesk

- WeWork is the strongest brand in co-working space in

- He put $300M of his own money to buy these apartments

- Bet could be good

- Sacks - Craft doesn’t do non-software investments

- Stuff in physical world with atoms is 10x harder than to do with bits

- Most startups fail and Most founders are good - so together = many repeat founders

- WeWork is just REIT - Adam was able to pitch a non-tech REIT as a tech company

- WeWork is now a $3.6B public company

- He was pitching people that didn’t want to hear about REIT

- It seems he’s starting another REIT, except residential this time

- He has again found a technology investor to buy a non-tech company as a potential tech company

- REITs are very structured - most valuable REIT in the world is Prologis - $100B company, 1B sqft under management

- The only mistake Softbank made was a velocity of money mistake - should have done 10 years instead of 5

- a16z is also in the same boat except without the same quantum of money

- a16z wants to become Blackstone for technology - $35B

- Blackstone is $100B - credit, Private equity and real estate

- a16z is trying to build a public ownable security using technology

- They want to become a credible reliable institution to absorb 100s of billions of dollars

- Landlords care about high quality tenants - want to cover their bear market

- WeWork was highly levered to a boom cycle - arbitrage goes away in troubled times

- Flow is different - they’re going to create a brand for apartment living around the country

- Can he extract more rent and less vacancy from apartment units with financial decision?

- FFO = Funds from operations

- Its a positive for a16z - they’re being bold - their business model works by taking as much Oxygen as possible from the room - so always keep raising funds - like Blackstone, Carlisle, etc

- a16z wins

- Adam Neumann chose them

- 1 check to deploy $350M

- Biggest predictors of success in startup = second time founder - first round capital did survey a few years ago

- This might be ultimate case of that

- Housing Policy - Bay area, Houston, Miami differences

- Andreesen wrote essay during pandemic - “Build” - to build housing

- And last week wrote complaint to city of Atherton against multi-family housing, complaining about prices

- CA housing is a mess - tenant rights movements have gone so far that landlords cannot evict anyone - crazy taxes - 6% transfer tax - they took 6% of Sacks’s home

- Atherton example is zoning - you are buying a house in that neighborhood and investing in character of the neighborhood - so understandable that residents would be against that - builders can’t just come in and buy SFH and convert to apartments

- Look at areas around public transit like BART etc - and build up in that neighborhood

- What if someone built a skyscraper in the farm they buy next to you if you’re a farm owner?

- Venice and SF people are also able to object

- CA needs to build 3.5M by 2025 - focusing on a town with 7k people is not the place to fix it

- Atherton has bad flood infrastructure - there are no sidewalks, you just walk on the road - residents of that town wanted that lifestyle

- Just south of that - Menlo Park or Palo Alto - they could absorb it - but what if they also object?

- But now there is a state mandated objective for each town and zipcode and city to build more housing

- Millions of homes can only be absorbed in cities - SF has infrastructure to absorb it - they have sidewalks, stop lights

- Hypocrisy here is that its not for multi-story housing, its townhomes which will be $3M - most probably tech company CTOs

- Redwood City is awesome now - they built 10s of thousands units - and downtown there is awesome now

- WFH - 30-40 mins of commute + = quality of life suffers

- People are buying apartments for their nannies, etc

- Atherton can pay for the houses to be built in Millbrae, etc

- NYC is less sentimental about their buildings and are able to scale up and be dynamic

- Houston and Miami are doing better

- Houston has no zoning - hospital, school, etc

- This problem is worse in democratic states and cities - they want to gerrymander school districts - they want to protect tax dollars, to send to their public schools - zip code oriented scheme

- China, Saudi Arabia, Russia increase relations - should US be worried?

-

Xi Jinping went to Saudi Arabia - a month after Biden’s strained visit - his first visit in 2 years is to Saudi Arabia

-

After 6 years of negotiations, China will yuan for Saudi oil - this might hurt US dollar on global economic stage

-

China and Russia are doing military stuff in Russia

-

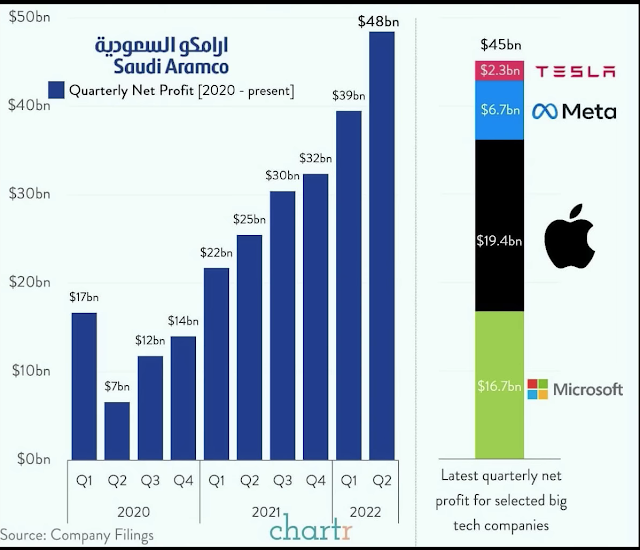

Saudi Aramco has most profitable quarter - more than Tesla, Meta, Apple, MSFT combined

-

Saudis are buying shares in Alphabet, Zoom, MSFT - $600B in US equities - US is dependent on Saudi funding

-

Is the future a China, Russia, Saudi axis?

-

Biden in his 1st year pushed Saudi Arabia into China’s arms

- He called them a pariah

-

He lowered US energy production and ruined relations with Saudi, etc

-

Better to be friend with them than to not have them as a friend

-

Deal with the regime that they have instead of complaining about it - we don’t know regime change will work in US favor

-

Basically declared US to be in proxy war with Russia - its dangerous for US even if you feel sorry for Ukraine

-

Ukraine war could escalate out of control and poses huge global risk - John Mearsheimer just wrote another article

-

This is opposite of Divide and Rule - China and Russia have not been friends traditionally - they are neighbors who have issues typically - and now US is uniting its enemies

-

Every country in the world should monetize their natural resources as much as they can

- And diversify by leveraging sovereign wealth funds

-

We should collaborate with frenemy countries

-

PhD student in Leeds went to jail in Saudi Arabia on vacation because she retweeted people

-

- Inflation Reduction Act

- Climate change improvements might be good

- This bill gets rid of Carbon Tax basically

- This will put everything on a level playing field and let the market play it out

- CBO says we will increase deficit by $330B next 5 years and decrease $320B next 5 years

- 87000 IRS agents are being hired

- Companies making more than $1B revenue will give

- IRS got $80B

- Imagine how much you could get from just a machine learning and AI startup to solve this tax exception problem - such a grift

- Bill Gates is doing a good job of investing in climate friendly companies

- Can increase national security

- Lots of Climate Tech funds

- JCal has his own syndicate also in this area

- Others are into energy, materials, food, industrial manufacturing

- Lot of startups’ unit economic models are good now - they will become profitable

- Chamath and Elon get audited every year

- Chamath employs a big4 accounting firm

- Ultra wealthy people can’t evade taxes - there is a lot of infrastructure there

- These IRS agents will come to us middle class and upper middle class folks

- Prescription drug price cap hurt pharmaceutical companies’ profits

- So companies are estimating that 2 fewer new drugs will come out every ear

- Real Clear Investigations

- Same group that raided Mar a Lago - led Trump Russia investigation - discredited, people went to jail from that - same people

- Christopher Rae instructed this unit to not take warrants from the FISA court

- How can this not create a conflict of interest or appearance of impropriety?

- We will move past Trump as a country but we should not create dangerous precedents that DOJ and FBI might be politicized

Comments